Property Management News

Loan processing times can now exceed 18-24 months HUD’s failure to keep pace with the volume of multifamily mortgage applications is exacerbating the nation’s shortage of workforce housing, jeopardizing the thousands of jobs created by new apartment construction and reducing the new revenues the program could be generating for the federal government. That is the message that the National Multi Housing Council (NMHC) and National Apartment Association (NAA) delivered to Congress today in testimony before a key subcommittee of the House Financial Services Committee. Testifying on behalf of NMHC/NAA, Peter Evans, a partner at Chicago-based Moran and Company, told lawmakers that... Read more

Weaker than expected job growth in May continues to push both fixed and adjustable-rate mortgages to new lows for the year, according to reports by Freddie Mac. The...

Adjustable rate mortgages are now eligible for securitization into K Certificates, Freddie Mac multifamily mortgage-backed securities. The Freddie Mac multifamily...

Flooding, Tornados Affect Housing Market Freddie Mac just released the results of its Primary Mortgage Market Survey® (PMMS®), which showed fixed-rate mortgages...

The “new normal” means more people will be renting, according to housing industry experts. Speaking at the Multi Housing Council’s (NMHC) Mid-Year...

The improving economy and job creation mean growing demand for commercial real estate, according to the National Association of Realtors. Lawrence Yun, NAR chief economist, said job creation will be the biggest factor moving forward. Job growth creates demand for commercial space, and the economy should be adding between 1.5 million and 2 million jobs annually both this year and in 2012, with the unemployment rate falling to 8.0 percent by the end of next year, he said. Given the minimal new supply in recent years, the rising demand means vacancy rates will be trending down in the commercial real estate sectors. Individual markets are now stabilizing and in some cases rising. From the... Read more

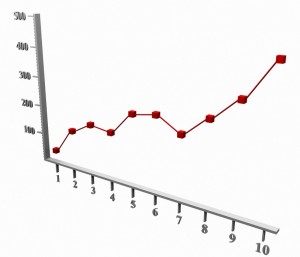

First quarter 2011 commercial and multifamily mortgage originations were 89 percent higher than during the same period last year, according to the Mortgage Bankers...

Fair Isaac Corporation –provider of the famous FICO Score, has developed a tool that can predict when a borrower is thinking about walking away from a...

Commercial and multifamily mortgage origination volumes increased 44 percent in 2010 over the previous year, with mortgage bankers reporting $118.8 billion of closed...

A new bill to improve the process for approving short sales may soon bring relief to stressed buyers who lose patience waiting for lenders to act. The bill, introduced...

Accessibility

Accessibility