Apartment Market Remains Stable

Lawrence Yun, NAR chief economist, said job creation will be the biggest factor moving forward.

Job growth creates demand for commercial space, and the economy should be adding between 1.5 million and 2 million jobs annually both this year and in 2012, with the unemployment rate falling to 8.0 percent by the end of next year, he said. Given the minimal new supply in recent years, the rising demand means vacancy rates will be trending down in the commercial real estate sectors. Individual markets are now stabilizing and in some cases rising.

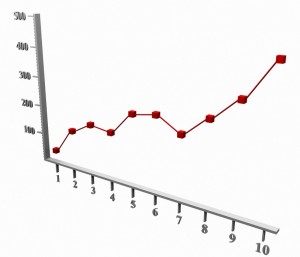

From the second quarter of this year to the second quarter of 2012, NAR forecasts vacancy rates to decline 1.1 percentage points in the multifamily rental market.

A separate NAR commercial lending survey shows 65 percent of Realtors report lending conditions have tightened thus far in 2011, and six out of 10 failed to complete a transaction this year due to financing problems. Regional banks provide the majority of commercial loans, followed by private investors. National banks are a distant third.

Just as in the residential sector, lending problems are the biggest issue impacting commercial real estate, Yun noted.

The multifamily sector is the only area that has clearly turned the corner, resulting in consistently falling vacancy rates and rising rents. Solid rises in apartment rents will force some renters to consider home ownership, Yun said.

NAR’s latest COMMERCIAL REAL ESTATE OUTLOOK2 offers projections for multifamily markets. The apartment rental market ” multifamily housing ” is continuing to tighten as household formation grows. Multifamily vacancy rates should drop from 5.8 percent in the current quarter to 4.7 percent in the second quarter of 2012.

Areas with the lowest multifamily vacancy rates presently are Pittsburgh; San Jose, Calif.; and Portland, Ore., with vacancies below 3 percent.

Average apartment rent is likely to rise 3.4 percent this year and another 4.3 percent in 2012. Multifamily net absorption is forecast at 250,800 units in 59 tracked metro areas in 2011.

With AAOA, landlords have resources at their fingertips. Check out our Landlord Forms page.

American Apartment Owners Association offers discounts on products and services for landlords related to your rental housing investment, including rental forms, tenant debt collection, tenant background checks, insurance and financing. Find out more at www.joinaaoa.org.

Accessibility

Accessibility