Crucial End-of-Year Housekeeping Tip for Landlords

While the end of the year is a very busy time of the year for most of us on a personal level, it is usually a slow period for landlords. Many of us spend this time working on our taxes, cleaning out our desk drawers and preparing for the New Year.

One often overlooked piece of housekeeping that impacts your profit is old tenant files which still have balances due.

them away and forget them. By storing these files without taking any action, you are literally throwing money away.

them away and forget them. By storing these files without taking any action, you are literally throwing money away.Take the time to do some end-of-the-year housekeeping. Start by separating old tenant files which have no balance due from the ones that owe. One by one, go through the files with balances to make sure each contains a signed lease; then, make a breakdown of what is owed.

There are three different options to select from when collecting your lost profit. Each has its pros and cons.

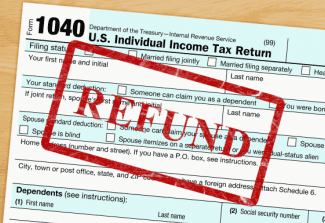

Report the debt to the three major credit bureaus, Experian, Equifax and TransUnion, as a collection account. The ding on your previous tenants credit report should remain there for seven years after they move out. There are several online resources for reporting tenant debt to the credit bureaus. It’s worth your time and effort to research them.

Too often, I hear landlords advising other landlords to forget any debt they are owed and move on because it is not collectable. From experience, I can tell you this is not true. While all of it may not be collectable, a percentage of it is, maybe not immediately, but over time, you can recoup some of your profit.

There’s only one way to ensure that you won’t collect any of the debt, and that is to do nothing, storing the files away and resigning yourself to accept the loss. Trust me when I tell you that doing nothing will cost you profit.

See How to Screen a Tenant Who Doesn’t Have a Social Security Number

See our seven part series, Vital Tips to Increase Your Debt Collection.

American Apartment Owners Association offers discounts on products and services for landlords related to your real estate investment including REAL ESTATE FORMS, tenant debt collection, tenant background checks, insurance and financing. Find out more at joinaaoa.

To subscribe to our blog, click here

Accessibility

Accessibility