What’s the Difference in Capital Gains Taxes?

by Thomas F. Scanlon, CPA, CFP®

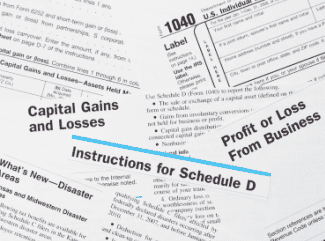

Capital assets are generally those held for investment. Stocks, bonds and mutual funds are some examples. If there is a gain on the sale of these assets, a capital gains tax is due.

Short-Term Capital Gains Tax

Short-term capital gains are those capital assets held a year or less. These are taxed at ordinary income tax rates. The highest ordinary income tax rate was just increased form 35% to 39.6% with the American Taxpayer Relief Act of 2012.

Long-Term Capital Gains Tax

Long-Term Capital Gains are those capital assets held for a year or longer. There are three stated rates, 0%, 15% and 20%. The 0% long-term capital gains rate applies to taxpayers in the 10% or 15% ordinary income tax brackets. The 15% rate applies to taxpayers in the 25% bracket. Married couples with taxable income over $450,000 and single filers with taxable income over $400,000 will be subject to the 20% rate.

Affordable Care Tax

The Affordable Care Act, also known as Obama Care added another tax to higher income taxpayers. There is now a surtax of 3.8% assessed on passive income. This tax will apply to married couples filing jointly with adjusted gross income over $250,000 and single filers with adjusted gross income over $200,000. Passive income includes interest (except municipal bond interest), dividends and capital gains, rents, and annuities. This will increase the effective long-term capital gains rate for the higher income earners to either 18.3% (15% + 3.8%) or 23.8% (20% + 3.8%). The short-term capital gains rate for the highest income earners is now 43.4% (39.6% + 3.8%).

Collectibles Capital Gains Tax Rate

Collectibles are taxed differently than most capital assets. Collectibles include coins, stamps, art, wine, books and gold and silver bullion. If they are held a year or less, they are taxed as ordinary income. Up to 39.6% in 2012. If they are held a year or more, they are taxed at ordinary income tax rates, up to 28%.

Depreciation Recapture Tax Rate

Certain capital assets need to be depreciated. One of these assets is real estate. This depreciation needs to be recaptured when these assets are sold. The capital gains rate on this recapture is up to 25%. When rental real estate is sold it will be a combination of depreciation recapture tax and capital gains tax.

Conclusion

Capital gains tax rates are confusing. They are also going up for higher income earners. Long-term capital gains rate are clearly preferable to short-term capital gains rates. Just don’t let the tax tail wag the dog.

Thomas F. Scanlon, CPA, CFP® is with Borgida & Company, P.C., Certified Public Accountants in Manchester, Connecticut, celebrating 44 years of tax, advisory and accounting services. Please call (860) 646-2465 or email [email protected] if you would like more information.

See 3 Proven Reasons You Should Be Prepared to File a Tax Extension This Year.

With AAOA, landlords have resources at their fingertips. Check out our new Landlord Forms Page.

American Apartment Owners Association offers discounts on products and services for landlords related to your rental housing investment, including landlord forms, tenant debt collection, tenant background checks, insurance and financing. Find out more at www.joinaaoa.org.

Accessibility

Accessibility