The Landlord’s Guide to Rent to Income Ratio

As landlords prepare to sort through and select a potential tenant, there’s one question that should always be top of mind: How can I determine if this tenant can afford the rent and pay on time every single month?

A handy solution: calculating the right rent to income ratio.

The last thing you want is to select tenants that can’t afford the rent or struggle to pay on time every month. This will lead to late payments, non-payments or, worse, potential evictions. The key to preventing these problems before they occur is to calculate an ideal rent to income ratio based on the tenant’s credit check.

So, how can one determine the amount of rent they can pay based on income? And, as a landlord, what exactly should be your income requirements for renting an apartment? That’s where a rent to income ratio comes in handy to help you determine a prospective tenant’s financial well-being.

What is rent to income ratio?

A rent to income ratio calculates the monthly or annual gross income a tenant must earn in order to feasibly afford their rent payment each month. If a prospective tenant’s income doesn’t meet that ratio, then they will probably struggle with your current rent.

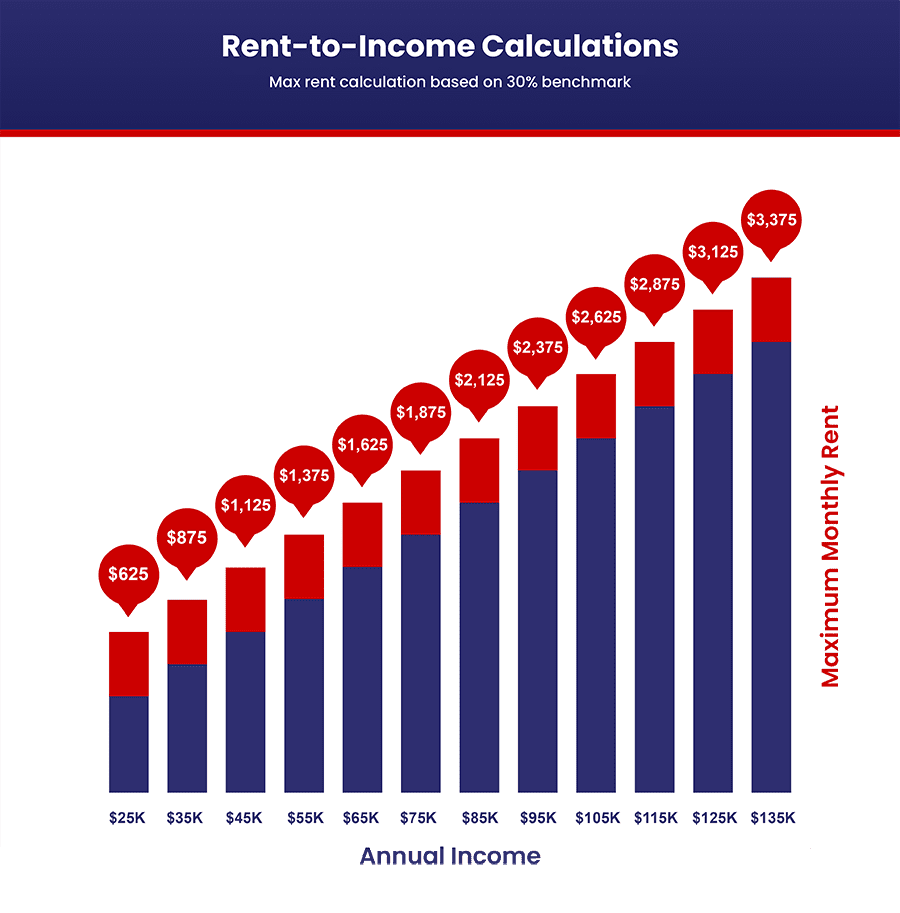

To determine the ideal rent to income ratio, landlords must figure out what percentage of their tenant’s income should go to rent. According to Chase Bank, the standard percentage would have no more than 30% of your tenant’s annual income going toward housing costs.

How to calculate rent to income ratio

Thankfully, calculating rent to income ratio only involves some simple math. Read on to learn three commonly used ways to determine this ratio:

Calculate gross income against a fixed rent percentage

This will help landlords and property managers determine the maximum amount a tenant can afford to pay in rent each month. As stated before, the industry standard is 30% of their income.

Below is the calculation for maximum monthly rental income:

(Gross earnings per year ➗ 12) X 0.3 = Maximum monthly rental income

For example, suppose an applicant earns $150,000 per year. The income to rent ratio will be:

(150,000/12) X 0.3 = $3,750

Now, if the rental site asks for $4,000 per month, the applicant would fail to meet this condition. This is because their maximum monthly rental income does not reach the required limit. Therefore, the landlord might not find the candidate eligible for renting.

Use a ratio multiplier

Another method to calculate the rent to income ratio is to multiply the monthly rent value with a ratio multiplier. In this method, the standard multiplier is 3. This means that the applicant should make at least three times their gross monthly income to cover rental expenses. The math would look like this:

Monthly Rent X 3 = Minimum monthly rental income

Let’s consider an example to better understand. Suppose the prospective tenant is interested in renting your apartment that is asking $3,000 per month. Three times this rent amount becomes $9,000. This means the prospective renter must gross a minimum of $9,000 per month in household income to be eligible for consideration.

Alternative ways to calculate rent to income ratio

As a rule of thumb, your renter’s income should be 40 times your rent, which is basically the same as 30% of their total salary. Almost every rent to income ratio calculator you find online uses this alternative way to calculate the ratio.

For example, suppose their income is $100,000 per year. The amount of rent they can afford each month can easily be evaluated as 30% of their total income divided by 12.

The math will look like this:

(0.3 * 100,000) / 12 = $2,500

Alternatively, you can simply divide the gross amount by 40.

(100,000 / 40) = $2,500

Why is the rent to income ratio important?

Each month, a tenant’s paycheck will go toward many different bills and obligations beyond housing. By gaining an understanding of how much monthly income is remaining, you’ll get a better idea of their ability to afford your rental’s monthly payment.

For landlords to recruit “good” tenants (those who pay consistently and on time), the rent to income ratio plays a very important role. It’s the primary way to determine income requirements to rent properties based on monthly or annual earnings. This helps ensure that the tenant is able to afford the rent each month.

As a landlord, you might not want to invest your time on ineligible tenants for your rental property. Calculating the gross income to rent ratio is an important step toward securing the right people for your rentals. Rather than going through the hassle of the screening process, use the rent to income ratio as your simple criteria instead.

Disadvantages of the rent to income ratio

However, ideal rent to salary ratio situations are not always as favorable as they sound. We know a lot of people aren’t that consistent in paying rents. Whereas, applicants who may not satisfy the income to rent ratio could be more responsible when it comes to paying rent on time.

The 30% rule is a popular guideline for determining what percentage of income should go to rent. However, there are two big flaws associated with this rule. First, it doesn’t account for inflation and rising rental prices. Although rent prices are climbing more rapidly in some areas than others, average wage growth has been much slower and less consistent. So, while rental rates are climbing, incomes aren’t necessarily keeping pace.

The second problem with the 30% rule is that it’s not personalized to each tenant’s situation. It doesn’t take into account, for instance, how much student loan or debt payments your tenant might be paying off. Moreover, it also does not consider how much money they are earning, their financial goals or the condition of the real estate market where they are applying to rent.

How can landlords protect themselves with a rent to income ratio?

Calculating rent to income ratio might seem effortless and manageable, but it could potentially hold a deficit for the landlord. Why? Because the landlord is not able to acknowledge the total worth of the tenant due to unspecified sources of income. The potential tenant may appear to have other financial obligations like loan percentage, fixed rate for insurance and indemnification.

Even after thorough screening, some people may delude and provide false income documentation. In any of the cases mentioned above, the landlord is fully granted the right to access all additional financial information of an applicant. Tenants should provide their last 3 months of bank statements, credit card bills, and any other financial records that may impact their ability to pay the monthly rent.

Before approving a tenant, make sure that all the certified funds, cashiers’ checks, money orders and records of the previous year’s taxes are officially provided. Even if your tenant qualifies as per the 30% rule, they may be overburdened with extra expenditures. In such cases, landlords need to assure ways to protect themselves.

Landlords can do this by:

Setting up recurring rent payments

Auto-pay services provide a convenient method of direct deposit with rent deduction on a specified date. It also provides more assurance of getting paid on time each month if payments are set up to recur.

Requesting a large deposit as a backup provision from any uncertainty or loss

A larger security deposit offers greater security because it can cover the landlord’s losses in case of damages or missed rent.

Specifying a co-signer on the lease

The co-signer is responsible to pay the rent in case the primary leaseholder cannot. The landlord should vet the co-signer as thoroughly as the tenant.

Running a thorough background check

Check the tenant’s background and inquire about past rental history. Also, be sure to comb through what your tenant presents as evidence. Cross-check all the references provided. Verify and validate all means of income sources. Gather data regarding any individual or collective payments or transactions. Once the property is rented, conduct routine inspections to prevent major problems.

Get help with AAOA

Rent to income ratio can benefit both the landlord and tenant. It can help with budget planning for tenants looking to comfortably afford their rent and also prevent landlords from renting to tenants who may have difficulties paying their rent.

However, when it comes to screening and shortlisting a tenant, the rent to income ratio may not reveal enough about the tenant, their level of responsibility or honesty. Therefore, all landlords should be running tenant credit checks, in addition to, calculating rent to income ratios.

At AAOA, we help you identify qualified tenants with our tenant screening services for landlords. We offer a variety of rental background checks, many with tenant credit checks, providing you with the best data and value in screening packages anywhere.

Accessibility

Accessibility