Learn How to Defer Capital Gains Tax for 30 Years

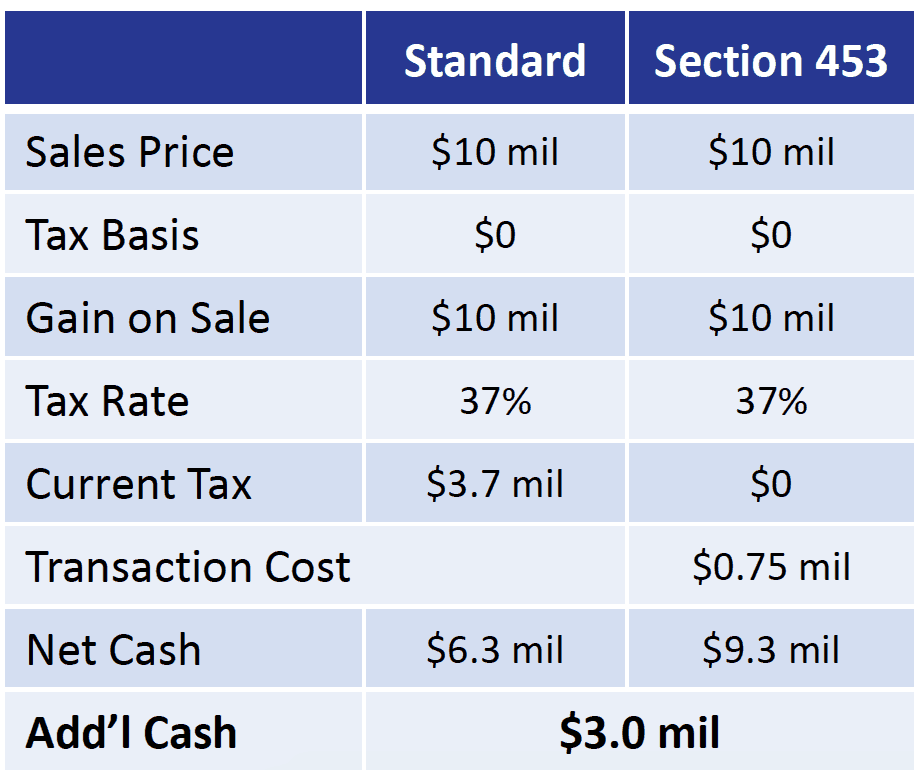

The monetized installment sales method under IRS section 453 works perfectly for any seller that wants to sell their business or real estate and desires to invest the sales proceeds in another investment activity. This tax planning can defer the capital gains tax up to 30 years and yet still provide most of the sales proceeds in the form of cash through a loan transaction from a third party lender.

In today’s Real Estate environment, many taxpayers are selling their real estate or business while the market is high and temporarily parking their money into other asset types or strategies. This allows these investors to go back into real estate or other investments when the Real Estate market goes down and the investments are more affordable. Successful investors know that you make your money from the purchase not the sale. Learn how this tax strategy along with our investment ideas and advice can potentially help you profit in this environment.

This tax plan often persuades taxpayers to sell the following types capital assets:

- Real Estate (residential or commercial); land, warehouse, office, apartment, hotel, strip mall, etc.

- Service businesses: CPA practice, law practice, insurance, real estate, engineering, architecture, medical, dental, senior care, etc.

- Any other business: restaurants, retail, wholesale, manufacturing, construction, flower shop, etc.

- Ownership interest in partnership/LLC and stock of privately owned corporations such as S corporations.

- Partner disputes and retiring partners

- Contract rights

- Farm property

- Collectibles (e.g., antiques, art, coins, gems, stamp)

- Trademarks

- Patents

- Goodwill

- Crypto or virtual currencies such as Bitcoin, Litecoin, etc.

Patrick Morehead and Vanclef Financial Group are not CPAs but we understand the strategies that investors need to know about and we educate our clients so that when they sit down with their CPA or Tax attorney, they save money and know what questions to ask.

If you are interested in learning more about this and many other tax saving strategies. Please reach out to Patrick Morehead, [email protected] or call (310) 410-8341

Accessibility

Accessibility