National Multifamily Report – February 2023

Annual rent growth continued to decelerate, up just 4.8 percent in February, according to Yardi Matrix data.

The average U.S. multifamily asking rent remained flat at $1,702 in February, according to Yardi Matrix’s latest survey of 140 markets. Year-over-year rent growth continued to decelerate, up 4.8 percent, a 70-basis-point decrease from January, marking the lowest increase in nearly two years. But this stagnating performance is not necessarily a bad sign, as in the six years before the post-pandemic surge, rents grew by an average of $2. After the seasonal winter slowdown, rent growth will depend on household growth and new stock and remains to be seen if it follows the typical spring pattern when rents typically pick up. Occupancy stood at 95.2 percent, 100 basis points below the late-2021 peak. The single-family rental market mirrored the multifamily sector, with the average U.S. asking rent flat at $2,071, the equivalent of a 3.4 percent year-over-year increase, far from the 14.8 percent growth rate registered a year ago.

The job market and consumer spending growth were healthy, but the higher-than-anticipated inflation increase in February raises concerns. Rising rates will keep transaction activity low and capitalization rates may continue to grow, detrimental to property values. Moreover, the cost of mortgage debt is trending up again. Many sellers refrain from dealing while prices are down, and if rates continue to increase, the recovery of property values will take longer.

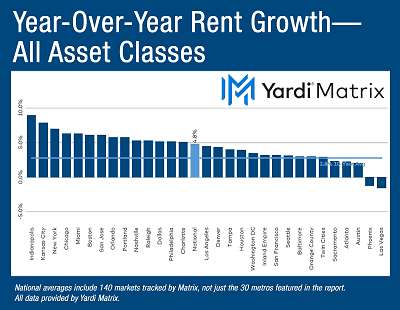

At metro level, rent evolution was uneven. Asking rent growth was positive year-over-year in almost every metro, but 23 of Yardi Matrix’s top 30 metros showed negative growth over the last three months and 17 were negative in February. Indianapolis again led in year-over-year rent gains in Yardi Matrix’s top 30 metros, up 9 percent, followed by Kansas City (7.9 percent), New York (7 percent) and Chicago (6.3 percent). Many of the high-performing metros over the last two years are now negative—Las Vegas (-1.6 percent) and Phoenix (-1.2 percent)—or barely positive—Austin (2 percent), Atlanta (2.2 percent) and Sacramento (2.3 percent).

On a monthly basis, the average U.S. multifamily rent remained unchanged from January. Rents in the upscale Lifestyle segment declined 0.2 percent, and in the Renter-by-Necessity component were up 0.2 percent, which indicates that affordability plays a big role in demand. Of Yardi Matrix’s top 30 metros, 23 registered monthly decreases and only five posted increases. New York (0.8 percent) and Kansas City (0.3 percent) led by far the other metro in Lifestyle gains, while Phoenix, Orange County and San Jose (-0.6 percent) and Seattle (-0.7 percent) ranked at the bottom. The dynamic was reversed in RBN, with 19 metros registering monthly gains and seven marking declines. Miami (0.9 percent) and Kansas City (0.8 percent) led in RBN gains.

Renewal rents rose just 8.8 percent year-over-year through December, 130 basis points below November’s rate, marking the lowest rate of renewal since early 2022. By historical standards, the rate remains high, but will soon decelerate in tandem with asking rents. Miami (16.8 percent), Raleigh (13.7 percent), Tampa (13 percent) and Kansas City (12.8 percent) posted the highest increases in renewal rents. With asking rents posting significant declines, renewal growth will follow.

The average asking rent in the single-family rentals segment rose 3.4 percent year-over-year in February, a drop of 80 basis points from January. Occupancy slid 10 basis points in December, to 95.7 percent, a 130-basis-point decline from December 2021. The 2011 – 2021 decade posted increases in the SFR households, but supply lagged, according to a study released by the National Rental Home Council. The organization reported that SFR households expanded by 3.1 percent in 2021 than a decade earlier. Furthermore, SFRs declined 1.6 percent as a share of overall housing stock. The segment’s construction pipeline comprised 107,000 units in communities of 50 or more units, according to Yardi Matrix’s database of build-to-rent properties.

Source: Multihousing News

Accessibility

Accessibility