How to Manage Extreme Weather Risk in Multifamily

Increasingly, developments are threatened by extreme risks beyond anyone’s control—and not just because of a global pandemic. With growing frequency, those of us in the real estate development arena have to consider the effects of extreme weather on a project and the myriad ways those weather events can derail budgets and schedules, if not appropriately considered.

Ice storms, mudslides, hurricanes, tornados, wildfires, floods, droughts—scientists advise we should expect to see these extreme weather events occur with more frequency and greater intensity in the years ahead.

Much of the advice multifamily developers and operators receive around extreme weather focuses on the here and now: mitigate damage from water and high winds, protect the building’s envelope, etc.

But these are merely physical risks. Developers and investors need to be mindful of the transitional risks, or the ways extreme weather can impact the broader market, from reduced labor forces to stricter building standards.

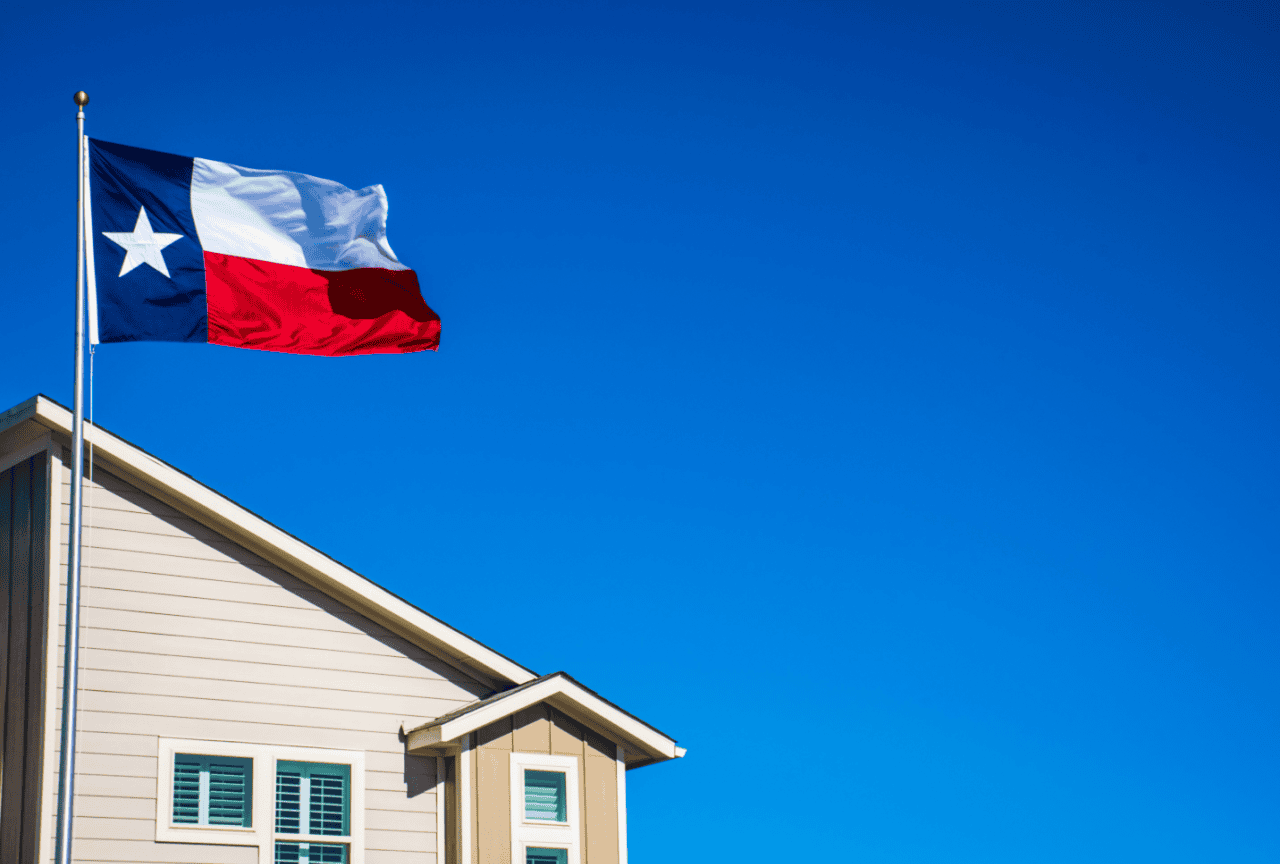

Take, for instance, the recent February ice storm, Uri, that blanketed Texas and potentially caused billions of dollars’ worth of property damage, as freezing temperatures and a lack of heat due to an offline power grid caused pipes to burst in homes, apartments and offices.

Several multifamily communities were caught off guard by damage to their outdoor pools, typically open throughout the winter given the state’s historically mild temperatures. By failing to winterize these features—draining water-circulating equipment or emptying pools—owners incurred considerable damage.

The pool problem was compounded by limited power, meaning it took days and weeks for pumps, filters and heaters to thaw for operators to assess the full extent of the damage—the physical risk. A severe shortage of plumbers, given the widespread damage throughout the state, further delayed repairs. Some experts cautioned the failure of the power system might even deter corporations looking to relocate to the state, which is a longer-term transitional risk that can nevertheless affect the overall multifamily market.

Another example of widespread transitional risk is the wildfires in California and Oregon last year that destroyed millions of acres of timberland, leveling 15 billion board-feet of timber—enough to build 1 million homes. Or consider the seemingly annual droughts impacting our nation’s water supply, which is critical to allow for continued development and growth.

THE NEW ABNORMAL

Welcome to the new abnormal, where risk comes from all directions and compounds instantly and creates a tangle of issues that have to be unwound and resolved to allow for appropriate risk-return profiles in real estate development.

But just because these threats are very complicated, it doesn’t mean we can’t manage through them. Developers and investors can reduce risk exposure in the following ways:

1. Identify risk through diverse perspectives.

Identifying risks through varied frameworks can help make mitigation and response much more effective. How would a developer with hospitality experience in the Northeast manage a multifamily project in a more moderate climate like Texas that is being affected by wider temperature swings? What insights can they bring that would ultimately benefit the project?

While no one person or team can manage development risk to zero, having diverse perspectives at the table provides a more holistic view of potential risk factors, meaning mitigation plans are adopted earlier in the project, ultimately reducing costs.

2. Connect leadership plans with on-site decisions.

Investors are typically looking at project risk over the course of months or even years, while on-site development teams are trying to manage risks and decisions from day to day. Work to create understanding and alignment between these perspectives to avoid dislocated interests and to keep projects moving forward appropriately, while being responsive to risks that arise.

3. Communicate your approach to extreme weather and other climate risks.

The entire real estate enterprise in our country has embraced environmental, social and governance measures to drive higher values and responsibility, especially in the development realm. Translating enterprise goals to the project level can be challenging but communicating priorities and steps to address the broader issue can keep projects on track and boost overall brand reputation.

We will never mitigate development risk to zero. Discipline, diversity and alignment, however, can help uncover looming threats that threaten projects while building strong ties between investors and development teams.

Source: multihousingnews.com

Accessibility

Accessibility