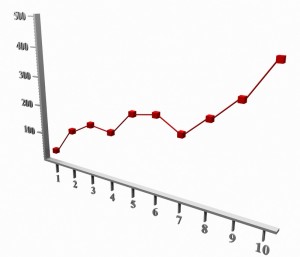

Apartment Insurance Costs Increase for the Second Consecutive Year

The survey covers data from more than one million apartment units, the largest number of units covered by the survey to date, operated by 55 apartment firms, tracking three principal components of insurance premiums: property, general liability and workers compensation.

The 9.5 percent increase in 2012 came entirely from property risk costs, with general liability and workers compensation costs staying virtually unchanged from 2011.

Respondents noted that their greatest challenges in 2012 came from obtaining adequate and affordable coverage in traditional catastrophe risk zones. In fact, catastrophe exposed properties were the major drivers of the increase in premium costs and higher deductibles, said Rick Haughey, NMHCs Vice President of Property Operations and Technology. With U.S. catastrophe losses in 2012 expected to be moderately higher than average due to Hurricane Sandy, the outlook for insurance costs in 2013 remains uncertain. This uncertainty mitigates what would be downward pressure on 2013 catastrophe rates due to strong underwriting capacity for primary insurers and reinsurers.

The survey also found that the mean average property cost of risk increased by 10.4 percent and average per occurrence deductibles increased to $118,000 from the unusually low average deductible of $66,000 in 2011.

The ACORS contains information about property, general liability, umbrella, workers compensation, D & O, professional liability, employment practices, environmental, and newly added insurance lines including terrorism and cyber liability. Fifty-five firms representing over one million apartment units supplied data on rates, deductibles, retentions, key coverage terms, claims history and more for the key lines of coverage.

With AAOA, landlords have resources at their fingertips. Check out our Landlord Forms page.

American Apartment Owners Association offers discounts on products and services for landlords related to your rental housing investment, including rental forms, tenant debt collection, tenant background checks, insurance and financing. Find out more at www.joinaaoa.org.

Accessibility

Accessibility