5 Things To Watch Out For When Investing In Low Income Neighborhoods

By Moses Vuma, Author of Gentrification for Investors: Secrets of Investing in Low-income Neighborhoods

Many real estate investors interested in low-income neighborhoods make the mistake of simply buying the cheapest property they find in the said neighborhood. In this article, I will highlight five (5) things to watch out for when investing in low-income neighborhoods. In my book, Gentrification for Investors: Secrets of Investing in Low-income Neighborhoods, I cover this information in detail, including security tips for protecting your properties in low-income neighborhoods.

1. Property Location Within the Neighborhood

Once you identify the neighborhood, the exact location of the property within that neighborhood will determine the success or failure of your investment. Within low-income neighborhoods, there are tiers of ‘sub-neighborhoods.’ If you purchase in the wrong sub-neighborhood you may have a hard time finding and keeping tenants. There are hardly any retail buyers in the cheapest neighborhoods – a large portion of the residents are usually renting. This means that you may find it very difficult to offload or sell the property if you make the mistake of buying in the wrong ‘sub-neighborhood’ within the low-income neighborhood. Your best bet at selling will be seasoned long-term real estate investors – and they will know how to negotiate to get the lowest price possible.

2. Properties Adjacent To Abandoned Buildings

Image source: Google Maps. Purchasing a property right next to an abandoned property is a major risk. Some of the disadvantages of this investment error are: (i) great, well-qualified tenants in low-income neighborhoods generally do not like living next to abandoned houses (because they know some of these pitfalls of living next to an abandoned house) (ii) It will be hard to find insurance for the property. Many insurance companies will not insure properties adjacent to vacant buildings in low-income neighborhoods. See point 5 below.

3. Suspicious Activity and ‘Hanging Sneakers’

A large police presence may also be an indication of crime levels and how the authorities are handling the situation.

Hanging shoes? When I first saw shoes hanging on a powerline at a street corner in Whitman Park ‘sub-neighborhood’ in Camden, NJ I thought they were commemorating someone who may have passed on at that location. It turned out that they were a sign that someone was selling some ‘unapproved drugs’ at that location. Of course, I am being modest by saying ‘unapproved drugs.’ The ‘hanging shoes’ sign should be taken into consideration with the other points listed here.

4. Funding

Generally, it is more difficult to get funding for properties in ‘very’ low-income neighborhoods. Hard money lenders, banks and private lenders know that it is very risky to depend on an asset in a neighborhood that is not performing well. Remember you will be getting a loan for a business – so banks and private lenders can review your property and its surroundings and decide not to fund it. Unlike retail loans, commercial loans can be denied based on location and level of risk. This is not legal or financial advice – consult with your legal and financial professionals for such.

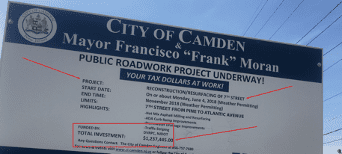

5. Municipal ‘Master Plan’

Check the local master plan provided by the municipality. Are there any plans to build or repair roads or to demolish abandoned properties? Even better, the municipality actively fixing infrastructure and demolishing abandoned properties. If the local authorities have no plans to demolish abandoned properties, revamp roads and attract investments, it will be best to avoid that neighborhood. On the flip side, the savvy investor may find gems in sub-neighborhoods that are being targeted for infrastructure improvement by the local authorities.

Conclusion

All these are important considerations before investing in low-income neighborhoods and helping people on Section 8 vouchers and other programs. It is important to know that Section 8 vouchers tend to pay very competitive rates. This means that a person on Section 8 may have many options and properties to choose from. In my experience, they will not choose a property that is not well renovated or if it is renovated well, they may not choose it if it is in the wrong neighborhood. They know the neighborhoods better than some investors. Information contained in this article should not be construed as investment or financial advice. The information provided here is only for educational and entertainment purposes. Please consult your legal team and financial advisors for legal and/or investment advice.

About the Author

Moses Vuma is versatile, passionate, and talented. Moses (AKA ‘Nkosi’) loves helping companies and investors grow their businesses. His background and experience span different industries and functions including financial analytics, public relations, digital marketing, and real estate. Raised in a farming family, Moses learned to take responsibility at a young age. He values spending time with his wife and two sons. Moses enjoys road running and is currently training for an ultra-marathon.

Accessibility

Accessibility