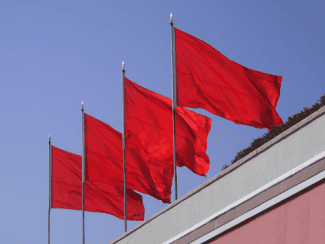

4 Red Flags to Watch Out for When Investing in Real Estate Syndications

People ask, is now a good time to invest in real estate?

The quick answer is Yes!

It is always a good time to invest in a good deal.

Passive Investors should rephrase the question of “is now a good time to invest in real estate syndications?” or “is it safe to invest in multifamily real estate in the current market?” to “what are good deals to invest in during the current real estate market?” I get it. There is a lot of fear and uncertainty.

For those who are experienced investors, this is nothing new. If you have only recently gotten started however, you may not have the battle tested scars to know what makes a good multifamily real estate syndication deal or not.

No worries.

If you are looking to be a hands-free passive investor, then you have to do some hard work upfront. In this article we will dive into some of the main red flags that passive investors should look out for when evaluating a multifamily real estate syndication deal.

Lack Of Track Record

A new deal syndicator that just came on the scene and has no prior track record is a huge red flag as a potential bad deal waiting to happen. Even if the fundamentals of the investment deal itself are good, the investment may not perform as expected because the deal sponsor does not have the experience and expertise to execute the plan as communicated in the offering memorandum.

Everyone has to start somewhere at some time, right? But not with your money of course. While some people may take this approach, it is not always the right one. A new deal sponsor may not be able to show a direct track record in syndicating deals, but they may have other indicators of potential success. If the deal sponsor has had success in other business ventures, either entrepreneurial or as an employee this may be someone that has the follow through to make the deal work.

Additionally, you can look to see who is on the team of the new syndicator, maybe there are other members on the team who have sufficient experience, expertise, and track record to make up for what the new syndicator lacks in experience.

You may also find it more profitable to invest with a newer syndicator as they may offer greater percentage of returns to help build their track record.

Questionable Character

When investing in a syndication you are making a bet on the team as much as you are on the deal itself. While a lack of track record is something that can be overcome, a lack of character is an insurmountable red flag.

A quick google search could save many an investor heartache in the future. If a deal sponsor has previously been involved in any sort of fraud, misappropriation, or any acts of the like then you would be best advised to invest your funds in another deal.

Ways you can gauge the character of a deal sponsor other than public information is asking to speak directly with the sponsor team or prior investors. You can ask them about prior failures and how they managed those failures. This will provide a great indicator of how the deal sponsor would treat your investment if things don’t go as planned.

Bad Debt and Equity Financing Structures

The topic of good and bad debt structures can go beyond the length of this article. Many times, what kills real estate deals is not the property itself or the team managing it but rather a poor match between the financing and the investment plan. Passive investors should look for protection on deals that have floating interest rate, deals that are not overly leveraged and financing that has a timeline that is longer than the estimated deal hold period.

Aggressive Underwriting

There is no deal sponsor that will admit that they have aggressive underwriting. Aggressive underwriting is an overly optimistic way to analyze an investment and its financial returns. This is a recipe for overpromising and under delivering. You could take a whole college level course on learning the nuances of underwriting a multifamily real estate investment opportunity. As a passive investor however, you probably are not going to get that intense.

You should know enough to know if a deal’s assumptions seem too good to be true. Look for things like deals that assume large rent increase every year, decreasing exit cap rates, rent and sales amounts that are not supported by any comparable properties and include refinances in their assumptions to make the returns look even better.

Even worse than aggressive underwriting is a sponsor that may not be aware of certain key metrics such as break-even occupancy. Ask the syndicator why they made certain assumptions. See if they can support their logic and ensure that their outlook is not overly rosy.

Keeping Your Investment Protected

There are a lot of investment opportunities out there. Not all opportunities are good opportunities. If you see any of the red flags mentioned, you should probably pass on the deal being presented to you. While there may be a valid explanation that can overcome a red flag, if you see multiple red flags, it is in your best interest to walk away.

One way to improve your investing prospects in the future is to share with the deal sponsor the specific reason why you are not investing in the deal and that may help them provide better opportunities in the future or connect you with other deal sponsors to increase the variety of investment opportunities you get to review.

Source: InvestUp

Accessibility

Accessibility