4 Lessons Learned From My Biggest Real Estate Investing Mistakes: Tips for New Investors

By Jason Malabute, CPA and full-time real estate investor

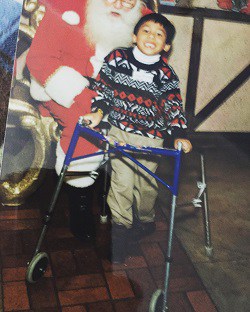

I’m Jason Malabute – a CPA and full-time real estate investor. I was born and raised in Los Angeles, but I invest in Indianapolis and Kansas City. My interest in real estate was sparked when I discovered the power of passive income while doing a tax client’s taxes. Soon after, I decided to transition out of accounting to pursue real estate investing through entrepreneurship, as my dad had always encouraged me to do so due to the challenges I could face in obtaining a high paying job with cerebral palsy.

Being a real estate investor and entrepreneur with cerebral palsy has come with its own set of challenges. One of the biggest struggles has been dealing with people’s doubts about my abilities and my own limiting beliefs about cold calling potential sellers and teammates over the phone. I thought they would not be able to understand me or take me seriously because of my disability. However, after thousands of calls with apartment owners, property managers, contractors, brokers, and being a guest on several podcasts I learned that these limiting beliefs were all in my head.

Despite these challenges, I am proud to say that I have never lost money in real estate. When I first started in real estate, I spent a year studying everything I could get my hands on. I watched every BiggerPockets podcast interview, asked hundreds of questions on the forum, and read all their books. From there, I took massive action and started to build my real estate portfolio. However, I had more determination than experience, and I made a lot of mistakes that I hope you can learn from.

Real estate investing can be tricky, but it’s possible to avoid mistakes by learning from others. Here are some of the biggest blunders I’ve made and the lessons I’ve learned:

- Don’t let brokers pressure you into buying a property that doesn’t meet your criteria or convince you that you can cut rehab costs to make the numbers make sense. One of my early mistakes was buying a property in Indianapolis. I was so excited to “buy something” that I compromised my criteria and chased the deal by paying more for the property and decreasing the rehab budget, which turned out to be a bad idea in the long run. Brokers may be focused on their commission and not your best interests. Get trusted contractors to assess rehab costs. Make sure that the comps you are using to justify the scope and budget of the rehab is comparable to the subject property’s location, size, age, and amenities.

- Always have reserves for a rainy day. With my first Indianapolis property I didn’t have enough reserves and it resulted in me paying for repairs out of pocket. As a conservative investor, you should have at least eight months of reserves for a rainy day, especially as we go into a recession. Not having enough reserves and not taking care of big capex items, such as roofs, parking lots, plumbing, and electrical systems saved money up front, but ate away at my cash flow in the long run. As a result, something broke almost every week, and I had to pay for repairs out of pocket. Talk to inspectors and budget for big-ticket items upfront.

- Get over the fear of networking and partnerships. I was scared to partner with someone because I grew up in a conservative Asian middle-class household where partnerships were seen as dangerous. However, I learned that partnerships could bring complementary skills, shared risks and rewards, and increased access to capital. For example, when I started investing, I was terrible at underwriting deals. If I had partnered with someone who was good at underwriting, I would have made better logical investment decisions. Additionally, if I had worked with a team when I first started, we could have combined our resources and networks to scale our real estate business. Build a team that has the same values as you and complements your weaknesses so you can scale your portfolio faster.

Remember, smart people learn from their mistakes, but smarter people learn from other’s mistakes. So, learn from mine and avoid the same pitfalls.

About the Author

Accessibility

Accessibility