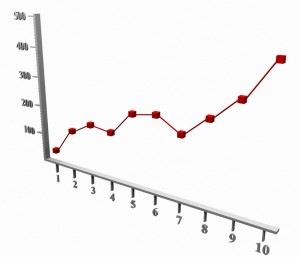

Multifamily Loan Originations Up 98 Percent

Lending on commercial and multifamily properties continues, said Jamie Woodwell, MBAs Vice President of Commercial Real Estate Research. Mortgage originations by life company portfolios hit another new record in the third quarter, and lending by bank portfolios and Fannie Mae and Freddie Mac also picked-up. Mortgage originations for the CMBS market, which was caught up in the global economic uncertainty of recent months, declined from last quarter, but were higher than last years Q3 level.

Third Quarter 2011 Originations 98 Percent Higher Than Third Quarter 2010

The 98 percent overall increase in commercial/multifamily lending activity during the third quarter of 2011 was driven by increases in originations in most property types. When compared to the third quarter of 2010, the increase included a 406 percent increase in loans for hotel properties, a 164 percent increase in loans for retail properties, a 103 percent increase in loans for office properties, a 39 percent increase in loans for multifamily properties, a 3 percent decrease in industrial property loans and an 8 percent decrease in health care property loans.

Among investor types, loans for commercial bank portfolios increased by 433 percent compared to last years third quarter. There was also a 169 percent increase in loans for conduits for CMBS, a 61 percent increase in loans for life insurance companies and a 47 percent increase in loans for Government Sponsored Enterprises (or GSEs ” Fannie Mae and Freddie Mac).

Third Quarter 2011 Originations 10 Percent Higher Than Second Quarter 2011

Third quarter 2011 commercial and multifamily mortgage originations were 10 percent higher than originations in the second quarter of 2011. Compared to the second quarter, third quarter originations for retail properties saw a 37 percent increase. There was an 8 percent increase for office properties, a 4 percent increase for hotel properties, a 2 percent decrease for multifamily properties, a 14 percent decrease for industrial properties and a 30 percent decrease for health care properties.

Among investor types, between the second and third quarters of 2011, loans for commercial bank portfolios saw an increase in loan volume of 55 percent, loans for GSEs saw an increase in loan volume of 32 percent, originations for life insurance companies increased 3 percent and loans for conduits for CMBS decreased by 48 percent.

With AAOA, landlords have resources at their fingertips. Check out our Landlord Forms page.

American Apartment Owners Association offers discounts on products and services for landlords related to your rental housing investment, including rental forms, tenant debt collection, tenant background checks, insurance and financing. Find out more at www.joinaaoa.org.

Accessibility

Accessibility