What I Wish I Knew Before Investing In REITs

- Every investor makes mistakes. The most important is to learn from them.

- Today, I allow you to learn from all the costly mistakes that I made in my early REIT investing career.

- Some discussion on REIT investing strategies and how to maximize performance.

I was lucky enough to get started on this journey at a very young age when my capital was limited to savings from summer jobs and other side hustles. I made many mistakes, lost money along the way, learnt from my past missteps, and become the (hopefully better) investor that you are today reading on Seeking Alpha.

That said, I can’t help but ask myself whether these costly mistakes could had been avoided if I had sought to learn more from other people’s mistakes. Specifically, when it comes to REIT investments, there existed very little published information back then. Today, we have multiple REIT-dedicated authors on Seeking Alpha alone – making it much easier for newcomers to learn from other investor’s experiences.

In an effort to pass along some of my costly lessons as a REIT investor, I describe a few points that “I wish I knew” before I started investing my hard-earned capital.

Confusing Categories of REITs

The REIT market is very vast with over 200 names – representing well over $2 trillion worth of properties in the US alone. This can get overwhelming at first. What makes it even more difficult is that each REIT is very unique in its structure, investment strategy, targeted properties, management quality, and balance sheet safety.

First off, it is important to distinguish between the two main categories of REITs: Equity REITs and Mortgage REITs:

- Equity REITs – The majority of REITs are publicly traded equity REITs. Equity REITs own or operate income-producing real estate. The market often refers to equity REITs simply as REITs.

- Mortgage REITs – or mREITs provide financing for income-producing real estate by purchasing or originating mortgages and mortgage-backed securities and earning income from the interest on these investments.

Then after this first categorization comes all the different REIT subsectors including:

- Office

- Industrial

- Net Lease

- Apartments

- Single Family Houses

- Manufactured Housing

- Shopping Center

- Mall

- Specialty

- Lodging

- Healthcare

- Diversified

- Data Centers

- Infrastructure

- Home Financing

- Commercial Financing…

Each sector has its unique risk and return characteristics and picking the right sector at the right time demands specialist real estate skills that I was lacking back then. I went ahead and invested in REITs without paying attention to these differences – setting the wrong expectations on day 1.

Lesson: There are important differences between different property sectors that you need to understand before investing in REITs. As an example, net lease REITs may enjoy very consistent cash flow while hotel REITs experience a roller-coaster ride. Knowing where the differences are can literally “make or break” your REIT investments.

Importance of “Quality” Management

In my initial years as a REIT investor I put considerably more weight on the quality of the assets than the management. My rational back then was that anyone with a decent background in real estate can manage properties (almost) equally well. After all, what are they doing? Collecting rent checks, taking care of property maintenance, occasionally filling up a vacancy and so on – nothing spectacular, right?

Well, turns out that this may have been the costliest assumption of my early REIT investing career. The quality of REIT management teams can be very volatile with large discrepancies in skills, motivation and interest alignment.

Over a short investment horizon, this may not play a large role in explaining returns, but over longer time frames, nine times out of ten, the REIT that has a well-aligned and experienced management team will outperform the other REITs with more questionable managements.

Lesson: long term-oriented investors should put a greater focus on management quality than anything else. Over the long run, as the superior management keeps on making the right decisions, the value keeps compounding at a faster rate.

Never Lose Sight of “Value”

While the quality of the management, assets and balance sheet are all important, you cannot lose sight of the share price.

Price is what you pay, value is what you get. In this sense, a great company won’t make a great investment, unless the price is right. Many high-quality REITs such as Realty Income (O) are way overpriced and we would not expect outperformance from these high-quality companies.

You need to find what the market does not already know. As an example, W.P Carey (WPC) is arguably better positioned than Realty Income with a less retail centric net lease portfolio and better diversification. The company has an equally strong track record and solid balance sheet. Yet it trades at a sizable discount and much greater dividend yield.

Lesson: it is easy to get sold on the quality of operations and to forget to ask what price you are paying for it. The price is just as important as the underlying fundamentals. They go hand in hand and should never be considered in isolation.

Leverage Beyond the Balance Sheet

With stock screener, it is easier than ever before to simply screen REITs based on automated metrics such as Debt-to-Assets or EBITDA-to-interest.

The problem here is that first off, these metrics may often be misleading because the book value of REIT’s assets may not reflect the true underlying net asset value, and secondly, the EBITDA may not be a good measure of underlying cash flow.

Moreover, most investors appear to ignore that certain property types can bear more debt than others. As an example, apartment communities are famous for their high cash flow stability throughout the entire market cycle. Therefore it is much more reasonable to finance them with greater leverage than hotels for instance which are more cyclical. In many cases, an apartment community financed with 50% debt will be much safer than a hotel financed with only 30% debt.

Therefore, it is not enough to screen REITs based on generic metrics of a screening tool. Rather, investors should look at the real underlying cash flow, its resilience and compare the debt level to the underlying property type.

Lesson: the balance sheet needs to be considered in association with the portfolio and cash flow resilience. Some REITs can take much more leverage than others and still remain less risky. Generalizations based on generic metrics lead to mistakes.

Developing the “Right” Portfolio Strategy

After close to a decade of REIT investing, I have seen and experienced it all: growth strategies, momentum strategies, value investing, high yield strategies, special situation, indexing, …

There are a lot of different strategies to choose from; but perhaps the easiest option for REIT investing is to simply invest in the broader REIT market, utilizing an index fund such as the Vanguard REIT fund (VNQ). However, this means buying every REIT in the index, regardless of its current price, quality, prospects, or management. While “know-nothing investors” (to borrow a term from Charlie Munger) may find this broad diversification useful, we believe (as does Charlie Munger) that using an intelligent analysis of the qualitative and quantitative aspects of each REIT in order to pick and choose the most opportunistic investments will provide the best total-returns over the long term.

That said, analyzing REITs and designing a portfolio yourself is no walk in the park either. It requires specialist skills that are not widely available and there is a strong need for professional research to sort out the worthwhile from the wobbly.

In my early REIT investing career, I made the common mistake of being overconfident. I thought that I knew it all and beating indexes would be easy peasy. I was overly concentrated in a few risky bets and a single mistake end up costing me a lot in performance.

Lesson: the lesson here is to keep a realistic view of your limitations as an investor. When I started out, I had minimal real-life experience and very limited resources (expertise, capital, time). In this situation, passive indexes would have been better adapted for me. Today, my situation is very different as I work full-time for High Yield Landlord – a REIT investment newsletter, have ample resources and access to REIT management teams to conduct interviews.

Closing Notes: REITs Are Wonderful (if you know what you are doing)

Since I started investing in REITs, I have greatly profited from the sector and keep on enjoying high dividends today. I have made mistakes, but most importantly, I have learnt from them and now you can also benefit from my transparency to avoid falling into the same traps.

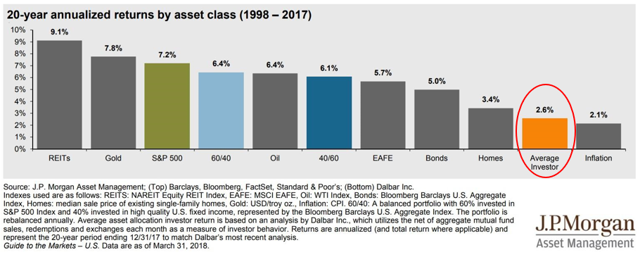

REITs can be truly wonderful but you need to know what you are doing. To demonstrate this, consider that the average investor generated only 2.6% per year over the past 20 years:

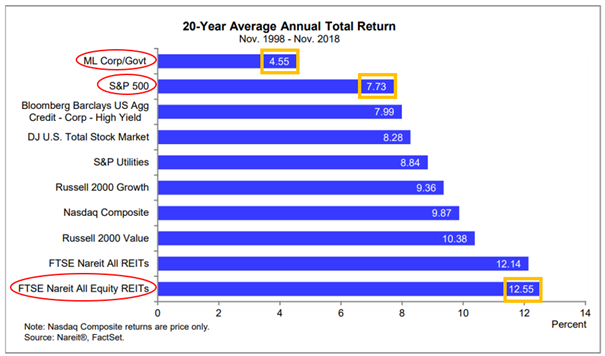

Clearly, the average investor does NOT know what they are doing. In comparison, passive REIT indexes returned 12.5% per year and outperformed almost all other asset classes:

Then taking it one step further, active and more entrepreneurial REIT investors who target market inefficiencies have managed to reach up to +22% annual returns over the same time period:

This is what we aim to do at “High Yield Landlord” by specializing in REIT investing. Our objective is to maximize performance by following an active approach to REIT investing with a special focus on value and high yielding opportunities. So far, the results are paying off and we are outperforming the market by a large margin while enjoying an ~8% average dividend yield.

Source: seekingalpha.com

Accessibility

Accessibility