Retiring On Monthly Dividends: The ‘Landlord’ Approach To Building Passive Income

Building a portfolio full of safe and passive income vehicles that not only covers your cost of living today but grows at a rate equal to or exceeding the rate of inflation is the retiree’s dream. However, it is not as easy as it may at first seem. Given the recent macroeconomic environment where interest rates have been at or near rock bottom, the growth in life expectancy, skyrocketing costs of medical care, and elevated asset valuations, achieving the “retiree’s dream” is as challenging as ever. However, we believe that this goal is still very achievable and devote much of our efforts at High Yield Landlord to assisting our over 300 members – many of whom are retirees or nearing retirement – with realizing this dream.

Rental Properties…

Like with most destinations, there are multiple avenues of approach. One popular approach these days is achieving financial independence and an early retirement through rental property investing. This process can lead to rapid wealth accumulation due to the ability to pour sweat equity into “fixer up” properties and deploy enormous leverage (in some cases up to 90%). Many pursue this path, and a significant number of people have achieved their financial goals as a result.

However, as we have written at length about in the past, these results do not come without considerable risk and effort. Effective “landlording” requires investing considerable time in research to find a good property in the right location at the right price. Additionally, it requires finding good quality tenants by advertising online, making house showings, running credit checks, and assessing the tenant’s integrity through interviews. It also can involve considerable legal work, to include signing the lease, getting a deposit, setting up a limited liability company, and finding a good lawyer for if/when the need arises. Maintenance of the property (i.e., leaky roofs, clogged toilets, and damaged carpets) and customer service (sometimes at very inconvenient times, with potentially very temperamental tenants) are also necessary to sustain your investment.

Finally, since each real estate investment typically requires a significant amount of capital, achieving a healthy level of diversification early on can be nearly impossible. As a result, significant stress can be placed on your finances if there are prolonged vacancies (during which the property becomes a liability rather than an asset) and/or a market downturn in which your equity is wiped out due to the heavy leverage placed on the property. Worse still, tenants sometimes will even suit their landlords for minuscule issues which can lead to long and costly battles in court and potentially even a loss of the property.

While real estate investing can be a great way to accelerate your journey towards financial independence and a rich retirement, it is not the safest or the easiest by any means.

Passive Indexing…

Another popular method these days is investing in low-cost passively managed index ETFs (such as the Schwab International Index Fund (SWISX), the iShares Core S&P Total U.S. Stock Market ETF (ITOT), or the SPDR S&P 500 ETF Trust (SPY)) consistently until you have enough in savings, where four percent of your principal is enough to cover your annual expenses. According to the “four percent rule” – also known as the Safe Withdraw Rate – is a framework that is used to determine how much of a stock portfolio can be spent each year without ever running out of money. Once this level of savings is achieved in a retirement account, the investor is declared financially independent and can then retire, supposedly confident that no matter what happens to the stock market, they will be set for life.

While this approach clearly wins the contest for simplicity, we do not believe it offers the best returns (i.e., requiring a longer journey to and/or lower quality of retirement) and also gives investors a false sense of security that their expenses will be met for the remainder of their lives.

Passive, low-cost index investing, while wildly popular at the moment, will likely have a hard time continuing its track record of 8-12% returns moving forward. This is because – thanks to the decade of extremely low interest rates – the stock market has reached astronomical valuations relative to its history. In fact, based on the historical ratio of total market cap to GDP, the stock market as a whole is forecast to generate negative total returns moving forward. Even if interest rates remain low for the long term (which is increasingly likely due to the heavy debt burden facing governments, businesses, and individuals across the globe), the rate of inflation will inevitably pick up, eating into real returns. Therefore, regardless of which scenario plays out, the real total returns of the broader stock market indexes are likely to significantly underperform their past history.

We also believe that passive, low-cost index investing will also disappoint investors from a safety perspective. The first safety issue stems from the assumptions involved. This rule is based on the assumption that the index fund will generate an average annual return of 7%. It also assumes that inflation will average at 3% over the long term. As a result, by withdrawing 4% per year, you are merely deducting the difference between the return of your index fund and inflation. The final assumption is that the retirement period will be 30 years. As previously discussed, the average annual return and/or the average inflation rate will likely not be the same moving forward as it was in the recent past due to the anomalies in interest rates. Additionally, the likelihood of increased market volatility in the coming years is growing as market valuations get increasingly stretched, corporate balance sheets get increasingly leveraged, and the global economy slows and threatens to slip into recession within the next few years. If this happens, it is very likely that stock indexes could see significant contractions in their valuation multiples. Under this scenario, adherents to the 4% rule would either have to reduce their standard of living or sell off more shares at cheaper prices (i.e., buy high, sell low). Either scenario will lead to a reduced retirement experience and lead to significant stress as investors watch their portfolio values (i.e., their life savings that they worked so hard to accumulate) fluctuate wildly in value.

CDs and Treasury Bonds…

A final, more old-fashioned, approach is saving earnings in FDIC-insured Certificates of Deposit (CDs) and treasury bonds. While this is certainly an extremely safe, passive, and easy way to save for retirement, unless you have a huge income, it is very inefficient. This is due to the extremely low yields found in minimal-risk cash investments and the fact that most of them do not adjust their yields to the rate of inflation. As a result, investors who choose this path will likely retire much later and/or live a much poorer lifestyle than they would have if they had pursued an alternative course of action.

Our Favorite Solution for Retirees…

While real estate, passive index, and treasury bond/CD investing each offer viable paths to retirement, they are faced with significant flaws that could lead to a less than desirable retirement experience. However, there is an alternative path which we believe involves the best combination of efficiency (maximum “bang” for each “buck” invested), passivity (freedom to enjoy your Golden Years), and safety (being able to sleep well at night knowing that your income stream is safe): investing in high quality real estate investment trusts (REITs) to build a portfolio that pays out growing dividends each month.

Depending on REITs that pay safe and growing dividends for retirement income combines the lucrative cash flow and long-term leveraged appreciation of real estate investing with the benefits of passivity and diversification that can be found in index investing. Additionally, the monthly cash flow alleviates many of the worries that come with stock market volatility by preventing retirees from having to sell shares while prices are low since they only live off of the income. Focusing on growing dividend income rather than the noise caused by volatile stock prices fits well with a long-term investment strategy and removes some of the emotional risk associated with investing.

Finally, since management in high quality REITs with a record of growing their dividends over time will only pay out excess cash flows as dividends, retirees do not have to worry about reinvesting their dividends if they don’t want to, knowing that REIT management is retaining all of the cash flow it needs to sustain and even grow the business. As a result, REIT investors can spend 100% of their dividend income and still very likely see their income and portfolio value appreciate over time. Rental property landlords have to practice much more savvy math in forecasting for themselves how much they will need to set aside for future repairs and/or to keep their properties competitive in their local market.

Of course, we would be lying to you if we said REITs were a magic fool-proof way to invest for retirement. As Ben Franklin once said:

“In this world nothing can be said to be certain, except death and taxes.”

Therefore, achieving proper portfolio diversification is essential for proper portfolio construction as it helps cushion one’s retirement income against the devastating impact of a surprise dividend cut. Fortunately, this is quite easy to do, as there are scores of REITs available. To further aid in the diversification process, we also view it as prudent – particularly in this environment – to keep some (10-25% of a portfolio) dry powder available in cash and precious metals as this provides ample flexibility to scoop up additional dividend growth stocks at steep discounts and elevated yields during periods of market volatility.

Our real-money portfolio at High Yield Landlord is a good example of how such a portfolio can be put together and how efficient it can be at generating sustainable and growing monthly passive income.

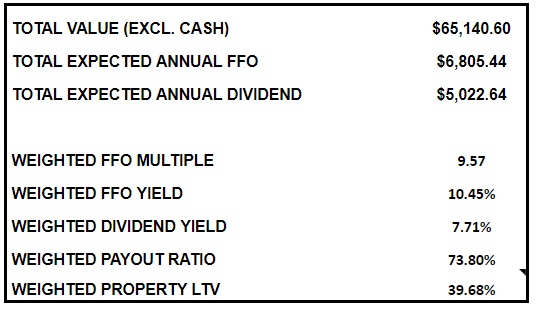

Source: High Yield Landlord Real Money Portfolio

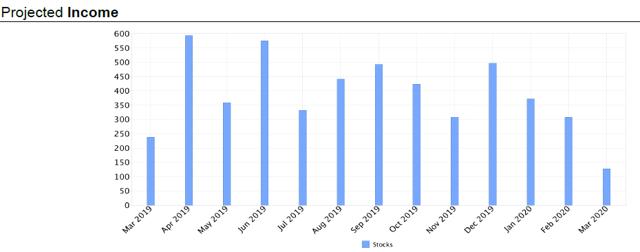

With a mere $65,000 allocated across 18 holdings whose quarterly or – in some cases – monthly dividends are staggered throughout the year, we are able to generate a dividend yield of ~7.7%, translating into average monthly passive income of ~$420, with at least $250 coming in every month. Over time, this will grow through a lucrative combination of dividend per share growth as well as reinvested dividends, creating a snowball effect.

Another important item to note is that our weighted payout ratio is only 73.8%, meaning that the REITs in our portfolio retain over a quarter of their cash flow, enabling them to reinvest in future growth and causing our shares to appreciate over time while also providing a considerable margin of safety for our dividend income.

Source: High Yield Landlord Real Money Portfolio

Of course, not just any REIT will do. Similar to rental property investing, REITs do require some upfront due diligence. However, the advantage with REITs is that once the due diligence is conducted, all that remains is checking in on the quarterly and/or annual reports to ensure that the business continues to be well managed and the dividend income is healthy. There are no maintenance phone calls in the middle of the night, no eviction court cases, no mortgage applications to bankers, or the need to recruit new tenants after a sudden vacancy in the property. REIT management handles all that very professionally and efficiently on behalf of its shareholders.

Rather than invest in a REIT ETF such as the popular Vanguard REIT ETF (VNQ), we seek outperformance more in line with what is experienced in individual rental properties while also enhancing the safety of our investments by weighting our portfolio towards REITs whose properties exhibit the following qualities:

- Good Location: It would need to be well-located in an area of high demand.

- Defensive Industry: The tenant needs to operate a solid business that can withstand varying market conditions and keep paying rents.

- Long Lease Term: The lease agreement needs to be long (+5 years) to guarantee cash flow even if we went into a recession tomorrow.

- Strong Rent Coverage: We want the tenant to operate a very profitable business so that even if its fundamental deteriorate, our rent payment remains secure. A 200% rent coverage ratio generally keeps tenant bankruptcies at bay.

- Inflation Protection: The lease needs to also protect us against inflation. The “triple net” lease structure is especially attractive because it puts the burden of rising property expenses on the tenant. Moreover, it also sets predictable 1-2% annual rent increases to account for inflation.

- Limited Leverage: Finally, the financing of the property needs to be secure. Any property can become risky if financed with excessive leverage.

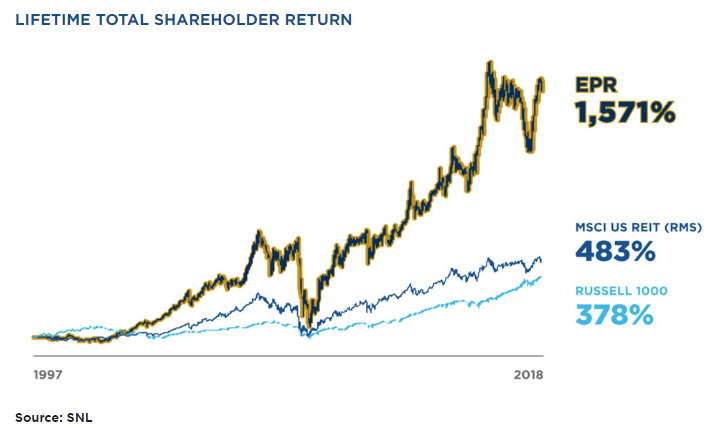

We view EPR Properties (EPR) – one of our favorite holdings – as a great example of the type of REIT that we would target for retirement income because of its long-term track record of paying regularly growing dividends with limited risk and robust stock market outperformance. From 1997 to 2018, EPR outperformed the broader stock market (IWF) by over four times. With a dividend yield of nearly 6% and a conservative payout ratio of ~75%, it is able to offer investors a powerful combination of attractive current income that also grows at a rate above inflation (~5%).

Further simplifying matters is the fact that it pays out dividends on a monthly basis, and its cash flows tend to be quite resilient regardless of the state of the economy.

Our objective is to own a diversified portfolio of ~20 REITs similar to this company to mitigate risks and diversify our income sources even further.

Ending Remarks

Our investment strategy for retirees is not rocket science. We aim to buy REITs at less than what they are worth in order to achieve high and consistent income along with capital appreciation. That’s it. It is just common sense that such strategy, when implemented correctly, can lead to fantastic investment results.

This is not, however, possible for everyone. We do this full time, it’s our only focus, we have great resources, and access to management teams to conduct interviews. We spend 1000s of hours and well over $20,000 per year researching the market to identify the few opportunities that are so clearly undervalued that they are expected to materially outperform.

Source: seekingalpha.com

Accessibility

Accessibility