Opportunity Zone Funds vs. 1031 Exchanges

One of the biggest advantages that we feel a QOZ fund offers is the need to only re-invest the gains from the sale of a property. Compared to a 1031 where both gains and cost base needs to be re-invested. The gain deferred can also be any one of the following as well:*

- Short-term or Long-term capital gains

- Unrecaptured Section 1250 gains.

- Collectible gains

- Gains from other Securities

- Net Section 1231 gains

- Capital gain net income IRC sec. 1256 contracts. *(Source: EisnerAmper-QOF 2019)

Min. holding requirements need to be met however to take advantage of these benefits.

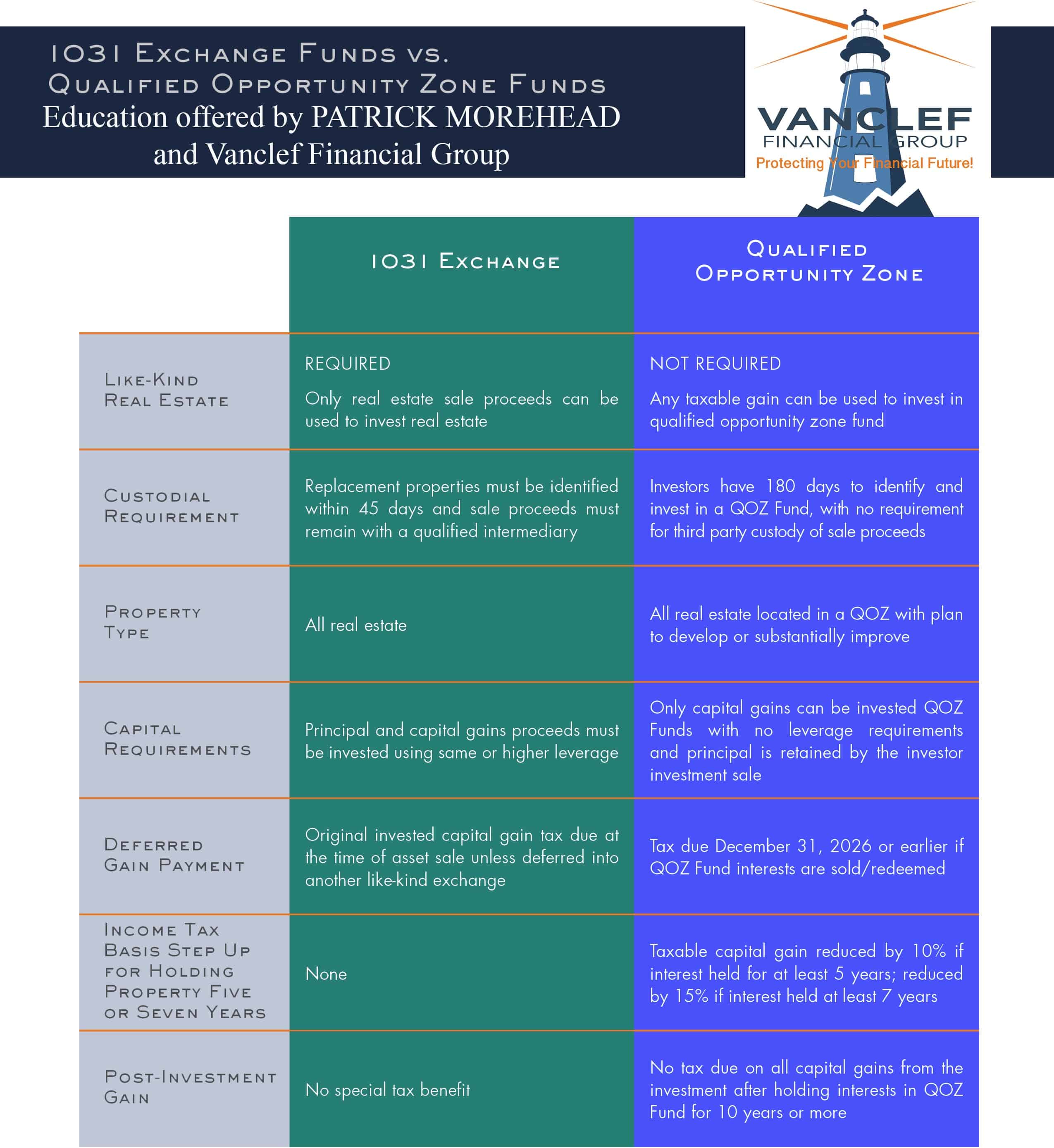

See the below chart for more differences between a 1031 and investing in a QOZ.

If you would like to learn more on how to take advantage of this great opportunity or have any other questions, please reach out to our Opportunity Zone Specialist: Patrick Morehead

Check us out at the AOA MILLION DOLLAR TRADE SHOW on Sept. 12th at the LA convention center BOOTH #119

The opinions expressed are those of Patrick Morehead and VFG and not those of WestPark Capital, Inc. Securities offered through WestPark Capital, Inc. Member FINRA / SIPC. Advisory Services offered through Delta Investment Management. WestPark Capital, Inc., Delta Investment Management and VFG are not affiliated companies. WestPark Capital, Inc., VFG and Patrick Morehead do not offer Tax advice.

Accessibility

Accessibility