Occupancy Rates, Rents Climbing

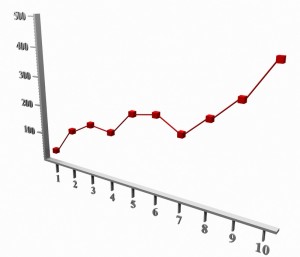

National occupancy climbed 0.2 percentage points during the three-month period, and effective rents for new leases jumped 0.9 percent. Annual revenue growth came in at 5.8 percent, with occupancy up 1.2 percentage points since early 2011 and effective rents up 4.6 percent.

An improving economy and fewer home purchasers spurred apartment demand, according to MPF.

The San Francisco Bay Area metros and Boston remain the nation’s leaders for rent growth. Annual increases for new-lease pricing are at double-digit levels of 12.6 percent in San Jose and 11.5 percent in San Francisco. Rent growth is at 8.1 percent in Boston and 7.7 percent in Oakland.

Rents for new leases rose 6.4 to 6.5 percent during the year-ending in first quarter across Austin, Denver, Pittsburgh, Charlotte and Chicago. Nashville completes the top 10 list for the largest rent increases among the nation’s biggest metros, with prices up 5.5 percent from first quarter 2011 to first quarter 2012.

With AAOA, landlords have resources at their fingertips. Check out our Landlord Forms page.

American Apartment Owners Association offers discounts on products and services for landlords related to your rental housing investment, including rental forms, tenant debt collection, tenant background checks, insurance and financing. Find out more at www.joinaaoa.org.

Accessibility

Accessibility