Apartment Market Improves Beyond Expectations: Double-Digit Rent Increases Possible

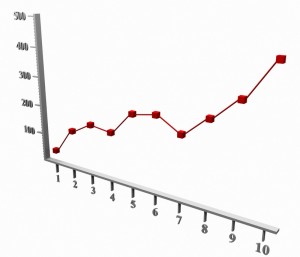

Expect vacancy declines, effective rent gains this year

Apartment fundamentals, which improved last year, will gather even greater momentum this year, according to the 2011 National Apartment Report (NAR) released by Marcus & Millichap Real Estate Investment Services, the largest real estate investment services firm.

Well ahead of expectations, apartments staged an incredibly strong comeback in 2010, despite weak job creation and stubbornly high unemployment, says Hessam Nadji, managing director, research and advisory services at Marcus & Millichap. Absorption of multifamily units increased significantly due to the release of pent-up renter demand as renter households de-bundled in the wake of the recession and home ownership continued to decline. The expiration of the first-time homebuyer tax credit, displaced foreclosed homeowners entering the renter pool, immigration and lower unit turnover also boosted absorption levels nationwide.

All 44 of the markets surveyed in the NAR are expected to post employment growth, vacancy declines and effective rent gains this year, confirming a sweeping recovery. The supply constrained markets of New York City, Washington, D.C., and Boston earned top spots in this year„¢s National Apartment Index (NAI), a snapshot analysis that ranks 44 markets based on a series of 12-month forward-looking supply and demand variables, including forecast employment growth, vacancy construction, housing affordability and rents. Meanwhile, Detroit, Las Vegas and Jacksonville ranked at the bottom of the NAI.

Although debt availability has increased substantially last year, Fannie Mae and Freddie Mac still dominated the market, providing apartment investors an advantage over other property types. Underwriting is still very tight and low-risk, higher-quality assets in primary markets are preferred by lenders, explains William E. Hughes, senior vice president and managing director of Marcus & Millichap Capital Corporation (MMCC). Assets priced above $20 million will continue to receive the majority of debt capital, as will class A and stable class B assets, leaving class C properties with fewer financing options.

Commercial banks and life insurance companies are stepping up to the plate, offering competitive financing options, according to Hughes. Despite the recent increase, the 10-Year Treasury yield will remain historically low, partly due to intervention by the Fed to keep the U.S. economy on a recovery track. The extension of quantitative easing will restrain interest rates in the near term, holding the 10-Year Treasury yield in the 3.5 percent to 4 percent range through most of 2011, making this year an opportune time to lock in low rates and acquire multifamily assets, Hughes adds.

Multifamily sales and pricing in primary markets will increase again this year, according to the report. Pricing for quality apartment assets in A locations turned aggressive in 2010, leapfrogging property fundamentals. REITs and institutions were responsible for much of this activity in the $20-plus million range, which placed downward pressure on cap rates and upward pressure on prices per unit.

Institutional investment capital has started to move toward Class B and secondary markets, says Nadji. This emerging trend is based on cap rate re-compression of 125 to 150 bps for top-tier assets in primary markets during the past 18 months. As the economy and investor confidence improve further, investors will increasingly look at these Class B assets and better secondary locations in search of yield. Development is also on the horizon in many metros, but supply will fall short of demand for at least the next few years.

With AAOA, landlords have resources at their fingertips. Check out our Landlord Forms page.

Accessibility

Accessibility