Property Management News

If you own rental real estate, you should be aware of your federal tax responsibilities. All rental income must be reported on your tax return, and in general the associated expenses can be deducted from your rental income. If you are a cash basis taxpayer, you report rental income on your return for the year you receive it, regardless of when it was earned. As a cash basis taxpayer you generally deduct your rental expenses in the year you pay them. If you use an accrual method, you generally report income when you earn it, rather than when you receive it and you deduct your expenses when you incur them, rather than when you pay them. Most individuals use the cash method of... Read more

A landlord can increase rent by up to a certain percentage or amount specified by local rent control laws. Rent increases are subject to local rent control laws which...

According to the Garn-St. Germain Depository Institutions Act of 1982, a mortgage lender may not exercise its option pursuant to a due-on-sale clause for...

Taxes are perhaps one of the most boring and painful of all topics that one can choose to discuss. That is unless you are a real estate investor! The ability of real...

The source of income law is in limbo now because on June 27, 2023, a Cortland County Supreme Court judge ruled that the law is unconstitutional to the extent that it...

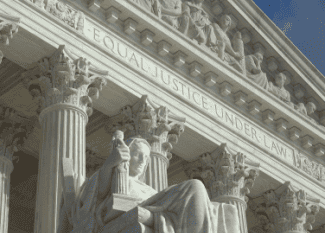

The California Apartment Association urged the court to hear a major property-rights challenge to tenant protections in NYC The Supreme Court on Tuesday declined to hear a challenge to New York’s rent control and eviction laws, putting an end to a case that might have had dramatic implications for California cities’ own tenant protection measures. A group of New York landlords had sought to overturn the state’s Rent Stabilization Law, arguing that its price and eviction controls violated the Constitution’s “takings clause,” which protects against the government taking private property without just compensation. The California Apartment Association and the San Francisco Apartment... Read more

Third, fourth, fifth bedrooms would be exempt from floor-area calculations. Los Angeles has introduced a bonus incentive to spur developers to build larger apartments to...

Wealthy baby boomers seeking to wash their hands of active property management in favor of passive investment opportunities are increasingly turning to a...

As a new year approaches, it can only mean one thing (besides a sudden spike in gym memberships); we’re that much closer to tax season. And whether you’re dreading...

A landlord can terminate a Section 8 lease if there is just cause. A Section 8 lease is a contract between a landlord and a tenant who receives rental assistance...

Accessibility

Accessibility