White House Considers Multifamily Housing Rules

Many Reiterate NMHC/NAA’s Call for Balanced Housing Policy

National Multi Housing Council (NMHC) President Doug Bibby represented the apartment industry and the NMHC/National Apartment Association (NAA) Joint Legislative Program at the high-level conference.

During the event, Bibby encouraged policymakers to consider the ramifications of any change in federal support for rental housing, focusing on the crucial contributions the market-rate apartment sector makes to providing workforce housing.

“Thanks to the liquidity provided by the GSEs, Fannie Mae and Freddie Mac, the apartment industry has been able to build and maintain millions of units of workforce housing,” said Bibby. “Few people realize that 90 percent of the apartment units financed by Fannie Mae and Freddie Mac over the past 15 years”more than 10 million units”were affordable to working families at or below their communities’ median income. This includes an overwhelming number of market-rate apartment properties with no federal subsidies.”

“The key message for policymakers to understand is that America needs rental housing now more than ever, but apartment loans are much more complicated than single-family loans, and history has shown that private capital alone cannot meet the industry’s needs,” explained Bibby. “During the transition to a new housing finance system, there must be an explicit federally backed credit facility for multifamily to have any hope of meeting our future housing demand.”

“It is also important that policymakers understand that in stark contrast to the single-family sector, the GSEs’ multifamily business has performed excellently, with default rates below one percent,” noted Bibby.

“We were particularly encouraged to see that multifamily was clearly not an afterthought at the conference,” said Bibby. “Several panelists commented on the need to include multifamily in the deliberations, and there was a robust discussion about the need to address what one participant called ‘the market distortions caused by the government’s disproportionate support of homeownership over renting’.”

“We look forward to working with Congress and the Administration on what will necessarily be a long and complicated process of designing a new housing finance system that adequately protects the taxpayer and provides for a robust source of capital for housing.

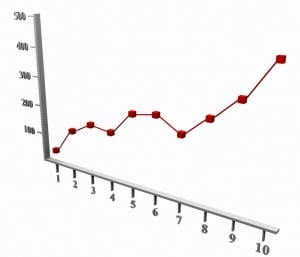

See U.S. Apartment Industry Shows Widespread Improvement.

American Apartment Owners Association offers discounts on products and services for landlords related to your rental housing investment, including rental forms, tenant debt collection, tenant background checks, insurance and financing. Find out more at www.joinaaoa.org.

Accessibility

Accessibility