A New Era of Operational Excellence for Multifamily

By Marc A. Hershberg, Managing Partner & CEO of Topaz Capital Group

Introduction

The multifamily industry grew massively over the last decade–total transaction volumes were up 250% from 2012 to 2018, the biggest year on record. For many individual property types, 2020 or 2021 were their best years yet.

The multifamily industry grew massively over the last decade–total transaction volumes were up 250% from 2012 to 2018, the biggest year on record. For many individual property types, 2020 or 2021 were their best years yet.

Even when faced with multiple headwinds in 2022–ongoing supply chain disruptions, rising inflation, and interest rate hikes–the overall resiliency of CRE was on display. Now, however, we are faced with more economic uncertainty than we’ve experienced in the last 15+/- years and those adverse external headwinds can create ripples for multifamily investors and owners.

In other words, the multifamily sector is entering into an era of operational excellence when faced with the most amount of “wild card variable expenses” since the last recession. In today’s case, there are genuine concerns as it relates to the banking sector’s turmoil and volatility, property insurance costs rising, job & wage deceleration, taxes & payroll, etc—all of which can erode margins, if not effectively managed. Employing creative and innovative solutions during this period to control expenses while increasing resident retention and increased leasing traffic is critical to keeping operating margins in the black.

Banking Sector Turmoil: Coming out of another adrenaline-fueled weekend to keep the banking world from imploding, The Federal Reserve on Wednesday is scheduled to announce its latest interest-rate decision as central banks around the globe confront banking-industry turbulence and still-high inflation. The US housing market is attempting to rebound, despite all this capital markets volatility.

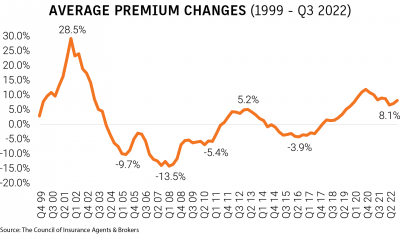

Property Insurance Rising: Seeing the spike in the chart above should drive anyone in pre-development to consider insurance a key influencer of design and material. The spike in costs follows directly behind increased construction costs for new buildings. Communities in development can lower risk through design, such as firewalls, and even location and asset selection. Managers and owners are approaching insurance brokers with portfolios versus individual properties to leverage scale and lower expenses.

Turnover and Retention: A vacant space is an expensive space. In multifamily, the unique relationship between the product—the customer’s home, workplace, play space, and largest monthly expense—means service is key. Mitigating the expenses incurred in preparing a vacant unit for a new resident starts with resident retention, and the use of technology that can identify customer pain points is critical. Artificial intelligence platforms that bubble up concerns to on-site teams can increase customer satisfaction and lead to more positive online reviews, all while returning work hours back to the leasing team.

Utilities: The cost of utilities is increasing even as appliances and fixtures become more efficient, and smart managers are conserving and monitoring energy use. Controlling a vacant unit’s utilities with smart-home devices helps reduce the owner’s bill, and installing sub meters with minute-by-minute connectivity immediately identifies energy peaks. Sensors and utility aggregators can also call out energy leaks and failing systems, leading to earlier repairs and a reduction in replacement costs.

Utilities: The cost of utilities is increasing even as appliances and fixtures become more efficient, and smart managers are conserving and monitoring energy use. Controlling a vacant unit’s utilities with smart-home devices helps reduce the owner’s bill, and installing sub meters with minute-by-minute connectivity immediately identifies energy peaks. Sensors and utility aggregators can also call out energy leaks and failing systems, leading to earlier repairs and a reduction in replacement costs.

Administrative & Maintenance: Technology coming into the space will offer preventative alerts like, “this is the fifth visit for this air conditioner” or “this boiler is aging”. Almost all management companies track these types of things, but not in a very efficient, technology-based way. These tools can also track employee engagement—how many call-outs they’ve had or company events they’ve attended—to monitor for burnout.” The new generation of residents demands more virtual access to their homes (i.e. leasing bots, self-guided tours, and apartment virtual apps) to help residents find, lease, and live in rental housing communities on their own terms. Successful vendor partners must adapt and future-proof a community as new amenities such as eco-friendly, solar-based, and electric vehicle charging stations, etc.

Payroll & Taxes: Payroll and taxes, trailing the list of recent increases, has been growing for a decade. Finding and retaining key employees such as maintenance technicians from a small labor pool means not just making competitive employment offers but managing their time cards effectively. Equally, taxes have been increasing significantly for payroll across most of the country. New mobile-friendly service request programs manage parts inventory and can reduce the back and forth among shop, customer, and management, with features including video and image sharing of problems and resolutions, and digital project status updates. Less physical oversight and implanted quality control increases efficiency and decreases repair time. As forward-thinking apartment communities shift from phone call to app, leasing and maintenance teams ensure fewer administrative duties and can focus on the customer experience. Smaller staff—or even no on-site staff—may not be far down the road.

Marketing & Leasing: Submarket competition, advertising costs, and leasing demand ebb and flow on a daily/weekly basis. Top-performing digital marketing providers can provide dynamic offerings that adjust to the property’s needs, turning off an expense when the perfect balance of occupancy and retention is found. Other tech platforms adjust rental rates daily, anticipating turnover, seasonality and competition. Ultimately, you will want to buy the most expensive online apartment rental website packages coupled with 4+ Star Average Google Reviews until you exceed your pro forma rents– or at least be in a position to field higher leasing traffic. [Text Wrapping Break][Text Wrapping Break]Another primary solution to alleviate strain on onsite teams is automation. Many routine processes can be automated, which results in giving time back to associates. This includes simple tasks like following up on leads—without sacrificing personalization. Automation tools can be customized to send follow-ups at ideal times and tailor the communication based on where a prospect is in the apartment-shopping process.

Conclusion

Finally, as a multifamily sponsor and investor, your goal is to define a backup plan and alternatives and sensitize your portfolio and cash availability to determine if you have flexibility for future exposure. No matter how you’re impacted, reacting quickly (and being proactive) is crucial. In other words, risk management is a key factor to coming out on the other side of these challenges unscathed.

“After going through three major downturns in the multifamily real estate industry, one of the key factors in maintaining your appreciative values is to hold true to your operational fundamentals. The “back to basics” philosophy while always striving to do the right thing in your organization will keep your management and construction firms well-grounded through the tumultuous times. And with the attention to detail relating to the needs of your existing residents and potential new residents on your properties is paramount.” –Randy X. Ferreira, Principal & CEO, Blue Roc Premier LLC.

You are encouraged to shift your investments to markets and submarkets with high and somewhat proven potential of rental growth and stability, and be well positioned not only to address current challenges but to take advantage of what may be once-in-a-generation investment opportunities as they become available. This year, we already are seeing opportunities to recapitalize deals that need equity at attractive rates and in protected positions, and we also believe that we will be able to buy built assets and developments at significant discounts with flexible and developer-friendly financing structures.

While inflation coupled with the banking system instability is affecting every industry and household, multifamily is perhaps the least exposed to these “external risks” within all the CRE asset classes, it does not mean that multifamily tenants and landlords aren’t susceptible as well. With expenses rising in almost every category of asset, property, and construction management, multifamily operators/owners must develop a systematic approach to adopt and pilot technology and innovative systems to raise the quality bar while reducing costs. These are just a few strategies to navigate this current climate in the short term in the face of increasing operational headwinds.

Source:

Real Page

The Federal Reserve

U.S. CPI Index

Topaz Capital Group’s Homepage

About the Author:

Marc A. Hershberg, Managing Partner & CEO of Topaz Capital Group (“TOPAZ”) – a leading multifamily private equity real estate firm founded in 2018 – is responsible for overseeing the origination and structuring of all of TOPAZ’s investment activities, as well as acquisitions, raising institutional-level capital and overall strategic direction and relationships. Prior to founding TOPAZ, Hershberg focused on Originations and Underwriting at Brick Capital Group (“Brick”), a premier New York-based private equity and debt firm with $200+ million AUM. Prior to working for Brick, Hershberg was supporting clients’ portfolios at UBS Financial Services with total investment accounts in excess of half a billion dollars with affiliated banks, insurance pension funds, sovereign wealth funds, public capital markets, and private equity firm allocations.

Marc A. Hershberg, Managing Partner & CEO of Topaz Capital Group (“TOPAZ”) – a leading multifamily private equity real estate firm founded in 2018 – is responsible for overseeing the origination and structuring of all of TOPAZ’s investment activities, as well as acquisitions, raising institutional-level capital and overall strategic direction and relationships. Prior to founding TOPAZ, Hershberg focused on Originations and Underwriting at Brick Capital Group (“Brick”), a premier New York-based private equity and debt firm with $200+ million AUM. Prior to working for Brick, Hershberg was supporting clients’ portfolios at UBS Financial Services with total investment accounts in excess of half a billion dollars with affiliated banks, insurance pension funds, sovereign wealth funds, public capital markets, and private equity firm allocations.

Hershberg graduated with a Bachelor’s Degree in Economics and Management from Yeshiva University Sy Syms Business School and a Masters of Science in Real Estate Investments & Finance from New York University. Hershberg is considered a CRE thought leader and multifamily news contributor for housing, development, and financing aspects of the commercial real estate industry. Hershberg spends much of his time involved in various local, national, and international-related not-for-profit charities.

Accessibility

Accessibility