Tax Firm Barred From Claiming Homebuyer Credit for Customers

The courts preliminary injunction order against Frika Tax Services will remain in effect while the governments lawsuit seeking a permanent injunction proceeds in court.

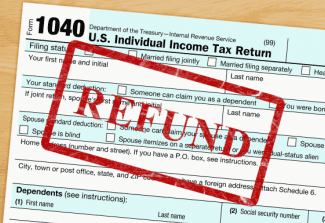

The court found that the firm’s accountant claimed the first-time-homebuyer credit for customers who did not qualify for the credit and claimed deductions for business and miscellaneous expenses that were erroneous, unrealistic or unreasonable.

The court also stated that, absent an injunction, many of its customers would be likely to underpay their tax liabilities and bear financial harm by having to pay overdue taxes, interest, and possible penalties. The firm must provide a copy of the injunction order to customers.

Return preparer fraud is one of the Internal Revenue Services Dirty Dozen tax scams for 2011. In the past decade, the Justice Departments Tax Division has obtained injunctions against a number of tax return preparers. Information about these cases is available on the Justice Department website.

Last week, an investigation revealed that the IRS allowed an estimated $513 million in homebuyer credits to taxpayers who were not qualified to take the credits.

With AAOA, landlords have resources at their fingertips. Check out our Landlord Forms page.

American Apartment Owners Association offers discounts on products and services for landlords related to your rental housing investment, including rental forms, tenant debt collection, tenant background checks, insurance and financing. Find out more at www.joinaaoa.org.

Accessibility

Accessibility