Rental Property Owners Become New Targets for IRS Audits

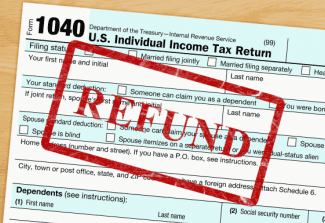

The IRS agreed to increase the number of audits of tax returns of landlords and rental property owners. An IRS audit of the tax return may result in tax assessment as landlords and rental property owners may be misunderstanding the reporting requirements. Besides the tax assessment a landlord or rental property owner could be assessed a tax penalty for misreporting.

One way to survive an audit is to make sure you have the proper documentation. One property management software – SimplifyEm.com, offers one-click tax reports including quick generation of Schedule E and 1099, as well as a comprehensive list of deductions to avoid year end confusion. In addition, SimplifyEm.com enables fast and easy income and expense tracking, tenant management, billing history and online rent payment.

This software was developed by TRexGlobal.com, whose products have been featured in Forbes, Chicago Tribune, Accounting Today, WebCPA.com, Inman News and other publications. The company has partnerships with Fidelity National Real Estate Solutions (FNRES), Atlanta Board of REALTORS®, Bay East Association of REALTORS®, San Diego Association of REALTORS®, IPX1031, RealTown “ The Real Estate Network, and many other leading real estate companies. More information is available at http://www.trexglobal.com.

See more Landlord Tax Tips.

Accessibility

Accessibility