Vacancy Rates, Rents Signal a Landlord’s Market

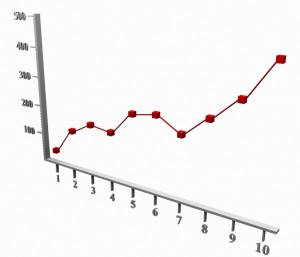

Lawrence Yun, NAR chief economist, points to sustained job creation as a major factor in the apartment market turnaround. “Vacancy rates are steadily falling. Leasing is on the rise and rents are showing signs of strengthening, especially in the apartment market where rents are rising the fastest.

NAR forecasts vacancy rates over the next year to decline another 0.2 percentage point in the multifamily rental market.

Household formation appears to be rising from pent-up demand, Yun said. The tight apartment market should encourage more apartment construction. Otherwise, rent increases could further accelerate in the near-to-intermediate term.

Construction activity is still low, with 95 percent of experts reporting it is below normal, and 83 percent said it is a buyers market for development acquisitions; prices are below construction costs in 78 percent of markets.

Multifamily Markets

The apartment rental market “multifamily housing” is likely to see vacancy rates drop from 4.7 percent in the first quarter to 4.5 percent in the first quarter of 2013; multifamily vacancy rates below 5 percent generally are considered a landlords market with demand justifying higher rents.

Areas with the lowest multifamily vacancy rates currently are New York City, 1.8 percent; Minneapolis and Portland, Ore., each at 2.5 percent; and San Jose, Calif., at 2.7 percent.

After rising 2.2 percent last year, average apartment rent is expected to increase 3.8 percent in 2012 and another 4.0 percent next year. Multifamily net absorption is forecast at 209,900 units this year and 223,600 in 2013.

With AAOA, landlords have resources at their fingertips. Check out our Landlord Forms page.

American Apartment Owners Association offers discounts on products and services for landlords related to your rental housing investment, including rental forms, tenant debt collection, tenant background checks, insurance and financing. Find out more at www.joinaaoa.org.

Accessibility

Accessibility